NEWS from Vertikal Net

Falcon launches resi dual guarantee

dual guarantee

Danish spider lift manufacturer Falcon Lifts is to offer guarantied residual values for its heavy duty spider lifts, in order to encourage buyers to trial its machines and help provide confidence to invest.

Falcon spider lifts are at the higher end of the market, the range starts off at 29 metres, but the average height of all the models sold is probably close to 37 metres or more. Its largest machine is the 52 metre FS520C.

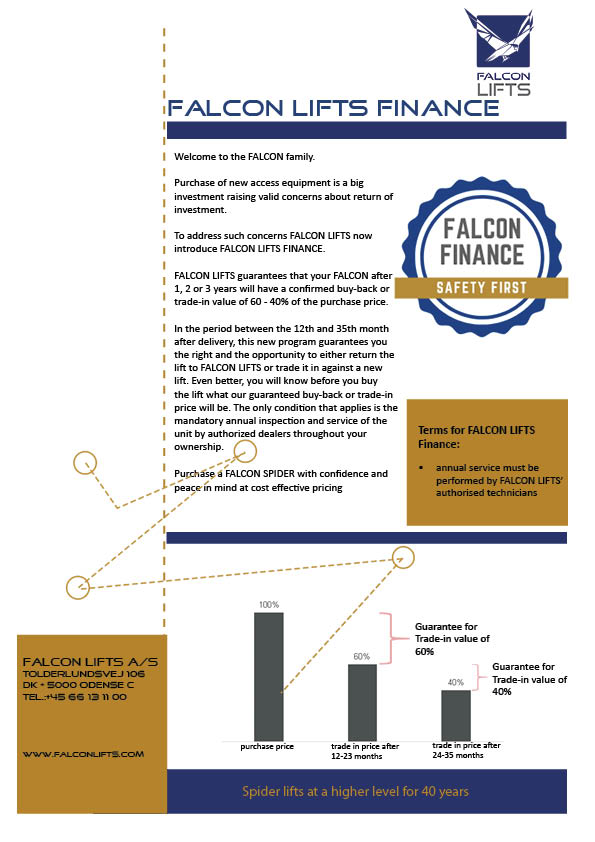

The proposal offers a guarantied buy back offer of up to 60 percent after one to two years, and 40 percent after two to three years. The only conditions are that the machine is serviced and inspected according to the company’s maintenance programme by authorised/trained technicians.

The company’s launch material for the new programme clearly states: “Investing in a Falcon Lift product is no longer just a safe investment from an operational point of view. Our new ‘safe investment programme’ offers more than fine words when it comes to the value of your Falcon lift: We guarantee to either buy it back or trade it in at a price we agree to before you buy the lift, no questions asked.”

]

Vertikal Comment

Investing in a big spider lift is a be and risky step for many rental companies or even end users, this programme is intended to help ease such a decision. It will of course help companies obtain financing by underwriting the residual, and given the levels proposed is not a major risk for the company. Falcon is not a mass producer and its products have a typical working life of well over 10 years, with plenty of examples of 20 year old models working within rental fleets.

We understand that the company has a decent order book, which begs the question why offer this programme now? However it says that it wants to spread the geographic coverage of its products and add to its distribution network and hopes that this initiative will help investors take the plunge.

Some companies will be concerned that programmes like this encourage rental companies that cannot obtain the finance to buy products that they do not have the skills to operate, and who then slash the rate to get the machine out, thus screwing up another profitable market. However the company says it is not offering any easy finance, finance underwriting, cash flow offers or balloon payment programmes that most critics believe cause of such practices.

It will be interesting to see how the programme develops.